- Academic Signal

- Posts

- PE Goes Retail: Individuals in the Game

PE Goes Retail: Individuals in the Game

New research shows wealthy individuals now hold $1–2T in PE assets—and their returns rival institutions. The real driver? Advisor quality, not wealth.

Welcome to Academic Signal, where we decode finance research into plain English to surface ideas that matter to professional investors.

PE is going retail: How individual investors are crushing it in private equity

First comprehensive study of wealthy individuals' PE performance reveals surprising results and identifies the real performance driver.

Democratizing Private Markets: Private Equity Performance of Individual Investors (June 2025) Link to paper

Private equity was once the exclusive playground of institutions and the ultra-high-net-worth (UHNW). But those days are starting to go away. New research reveals that individual investors now hold $1-2 trillion of the $13 trillion in PE assets – and they're performing far better than anyone expected.

But here's the twist: it's not about how much money you have. It's about who's advising you.

The democratization revolution is real

The traditional barriers to PE entry have crumbled faster than anyone expected. While traditional private equity funds typically required minimums of $25 million, many have recently dropped requirements to as little as $25,000 for accredited investors.

The research documents this trend systematically: minimum commitments for buyout funds fell from $5 million in the early 2000s to under $2.5 million by 2023. Venture capital minimums dropped even more dramatically, from $2 million to just $500,000.

This isn't some niche phenomenon. By the 2020s, 70-90% of GPs – including household names like Apollo, Blackstone, and BlackRock – were offering low-minimum funds. We're talking about $900 billion in capital raised across 6,000+ funds with sub-$1 million minimums.

But here's what's really fascinating: advisors are acting as capital aggregators. When individual investors can't meet minimums, their advisors pool commitments from multiple clients. The data shows clear "bunching" patterns where individual commitments fall well below fund minimums, but advisor-level aggregated commitments hit the thresholds exactly. It's like having a group buy for private equity.

Performance that shocks the skeptics

The conventional wisdom was that individual investors would get stuck with the "leftover" funds that institutions didn't want. The reality? Individual investors' aggregate PE performance is virtually identical to institutions.

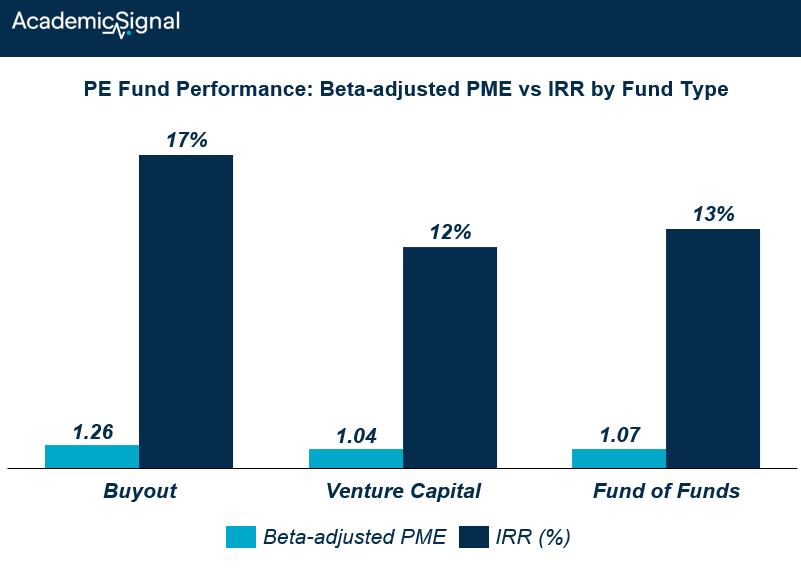

The numbers are striking, using the Public Market Equivalent (PME) return as a metric for comparison. The PME compares PE returns to public markets. It discounts all PE cash flows (contributions and distributions) using public market returns. For example, a PME of 1.26 = 26% outperformance vs. public markets.

Buyout funds: beta-adjusted PME of 1.26 (26% outperformance vs public markets), and IRR of 17%

Venture capital: beta-adjusted PME of 1.04 (4% outperformance) and IRR of 12%

Fund of funds: beta-adjusted PME of 1.07 (7% outperformance) and IRR of 13%

These returns are calculated net of GP fees and are remarkably consistent with institutional benchmarks from Preqin and MSCI-Burgiss (the delta is in the order of 1-3%).

Quick note about PME: In fact, the paper uses beta-adjusted PME as the key measure, which corrects for the fact that private equity doesn't have the same risk level as public markets. Standard PME assumes PE moves in lockstep with public markets (beta = 1.0), but venture capital is actually 30% more volatile than public markets. When you adjust for this higher risk, VC's apparent 18% outperformance (standard PME of 1.18) drops to just 4% (beta-adj PME of 1.04) - suggesting much of the "alpha" is really just compensation for bearing more systematic risk. This adjustment is crucial because it reveals whether you're getting paid for manager skill or simply for taking on more market risk than a public equity index would provide.

Where did the authors get the data? The researchers used data from Addepar, a wealth management platform that aggregates portfolio data for financial advisors. Think of it as the "Bloomberg terminal" for wealth managers. The platform tracks all assets (public and private) for high-net-worth clients, and the data is anonymized before researchers access it. This gave them cash flows from 65,000 investments across 17,900 investors and 4,500+ funds - representing $700 billion in PE assets.

The wealth gap paradox

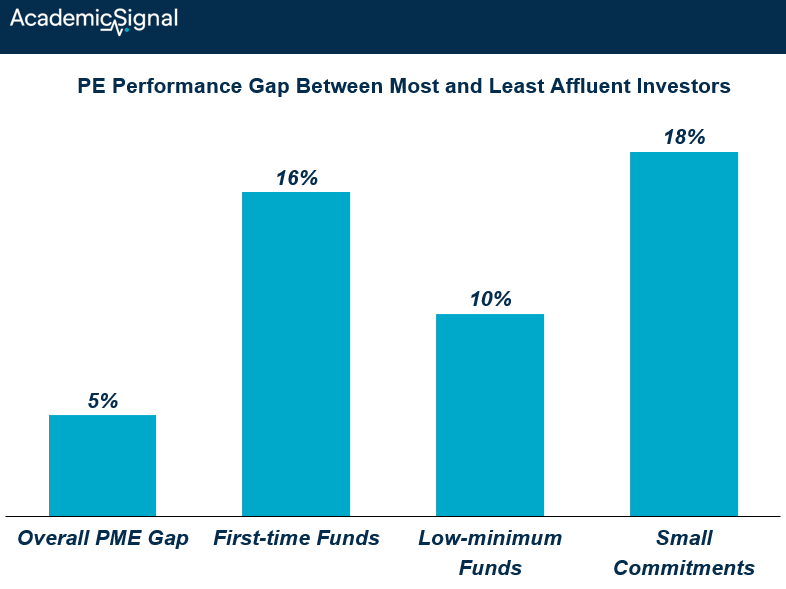

Here's where it gets interesting. While aggregate performance looks great, there's a massive performance spread across wealth levels. The most affluent investors (>$100 million) outperform the least affluent (<$3 million) by 5-10 percentage points in PME.

Your first instinct might be "of course – rich people get access to better deals." But the data tells a different story. The performance gap is largest precisely where access constraints should be minimal:

First-time funds (where GPs desperately need capital): 16 percentage point gap

Low-minimum funds (<$1 million): 10 percentage point gap

Small commitments (<$100K): 18 percentage point gap

This suggests the gap isn't about preferential access – it's about something else entirely.

The advisor effect: the real alpha driver

The smoking gun? When you control for the advisor, the wealth-based performance gap completely disappears. Which means: when you compare investors using the same advisor, wealthy vs. less wealthy investors perform similarly.

Experienced advisors (those managing clients’ funds invested in 5+ funds over the past three vintages vs inexperienced advisors who perhaps managed to get their clients only in 2 funds over the past 3 years) outperform others by 13 percentage points of PME. This effect persists even when looking only at first-time PE investors who presumably have no prior relationships or expertise.

Think about the implications: it's not your wealth that determines PE performance – it's who's picking your funds. The most successful advisors are effectively acting as skilled fund selectors and gatekeepers, similar to how investment consultants work for institutions.

Why do experienced advisors outperform by 13 percentage points?

The research doesn't definitively isolate the mechanism, but several factors likely compound.

Network effect: advisors managing more PE relationships build stronger ties with general partners, potentially gaining access to better funds or receiving more detailed due diligence.

Learning curve: advisors handling multiple PE investments develop pattern recognition for spotting quality managers and avoiding red flags that less experienced advisors might miss.

Survivorship dynamic – only advisors who consistently deliver strong PE returns can maintain active PE practices over time, as poor performers lose clients and allocation opportunities.

The “advisor fees” reality check (or the hidden cost of intermediation)

While individual investors match institutional performance at the fund level, they face an additional cost layer that institutions don't: advisory fees. Institutions typically manage PE investments with internal teams (salaried employees) and get direct access because they can meet the minimum requirements, whereas individual investors pay wealth managers 0.5-1.75% annually on total assets. Over a typical 8-year PE investment lifecycle, this creates roughly a 7 percentage point performance drag - and the burden falls heaviest on the least affluent too.

The fee structure creates a perverse outcome: less affluent investors (who pay 1.75% annually and already get lower returns due to working with less experienced advisors) see their entire PE premium almost disappear, with net returns dropping to essentially market levels, while wealthy investors (paying 0.50% annually) retain most of their outperformance.

For the least affluent investors, the combined impact of higher advisory fees practically wipes out their outperformance versus public markets. This isn't a flaw in private equity itself – it's a structural tax on retail participation that highlights why advisor selection and fee negotiation are critical for individual PE investors.

📊 Quick poll (vote to see the results)

How does the democratization of private equity impact your investment strategy? |

|