- Academic Signal

- Posts

- Short report “heat score” predicts impact + trading conflicting news stories for 30% return

Short report “heat score” predicts impact + trading conflicting news stories for 30% return

The authors found that activist short reports with more sources have a bigger and more persistent negative impact on the underlying stocks.

Welcome to Academic Signal, where we decode finance research into plain English to surface ideas that matter to professional investors.

In this week’s report:

A “heat score” that predicts the impact of activist short reports

Trading conflicting news stories can generate 30% annual returns

1. A “heat score” that predicts the impact of activist short reports

Short Sellers' Information Acquisition (Aug. 1, 2025) - Link to paper

TLDR

The authors found that activist short reports with more sources have a bigger and more persistent negative impact on the underlying stocks. They devised a Heat score, where higher heat = expect deeper and longer-lived price impact:

Heat score = 1x(public sources) + 3x(first-hand sources) + 2x(legal/government docs) + 2x(traditional-media investigations)

They interviewed 9 well-known activist shorts to map the workflow: idea generation, thesis validation, report writing.

They hand-coded 820 public reports (2010-2021). They identified 18 source types and grouped them into 7 buckets: firm fundamentals (filings, data vendors), traditional media, new media, legal/government, second-hand experts/data, first-hand work (interviews, onsite checks), and the short seller’s own analysis.

They split sources into 2 classes: pre-existing information (already public) vs new information (first revealed in the report).

They tested how source counts relate to returns over [0,1], [0,3], [0,5], [0,21] trading days, to short-interest dynamics, and to media sentiment around publication.

Key findings

#1: More sources = bigger impact

Even pre-existing public information still moves prices when packaged well. Each additional public source lined up with about -2.2bps over 2 days and effects that persist out to a month.

New information packs a bigger punch but takes longer to land. Each additional new source lined up with about -13.4bps over 6 days and roughly -24bps over a month.

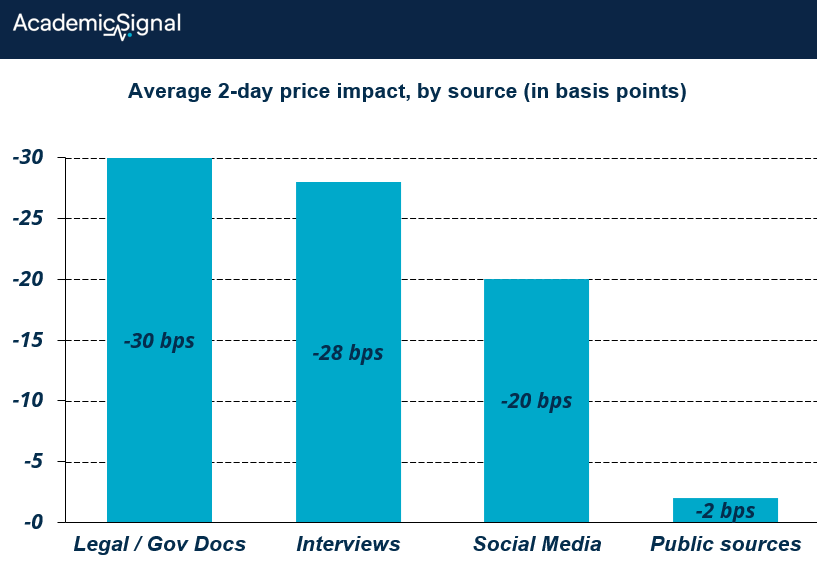

#2: Which sources hit hardest?

By subcategory, social media citations, legal documents, and stakeholder interviews showed the strongest associations with negative returns.

Specifically: +1 legal document linked to about -30bps over 2 days. +1 interview source linked to about -28bps over 2 days and roughly -48.5bps over a month.

Reports with many sources plus first-hand images were especially potent. In the top quartile for source count, a 1% increase in first-hand images was linked to an extra -69bps over a month.

#3: Positioning and press reaction

Short interest was higher right before release when the report contained new information, consistent with bigger positions on better private intel.

After publication, media sentiment turned more negative in proportion to the number of sources, especially when new information was disclosed.

Bottom line

Edge comes from 2 things: processing lots of public data better than the crowd, and adding a small layer of new, first-hand facts. When you see both in the same report, take it seriously.

2. Trading conflicting news stories can generate 30% annual returns

Conflicting News and Predictable Returns (Sept. 11, 2025) - Link to paperText

TLDR

When the headline of a piece of news sends one signal, but the actual news story sends a different signal, this conflict correlates with the underlying trading lower that day. A simple daily long-short that shorts “conflicting news” days and goes long neutral-news days earns strong risk-adjusted returns after controls.

The authors looked at a large set of company news stories from 2000-2024. For each story they measured the tone of the headline and the tone of the article body. Then they asked a simple question: what happens to a stock when the headline points one way and the body points the other way?

What “conflicting news” means in this context:

Positive headline, negative body.

Negative headline, positive body.

What they found

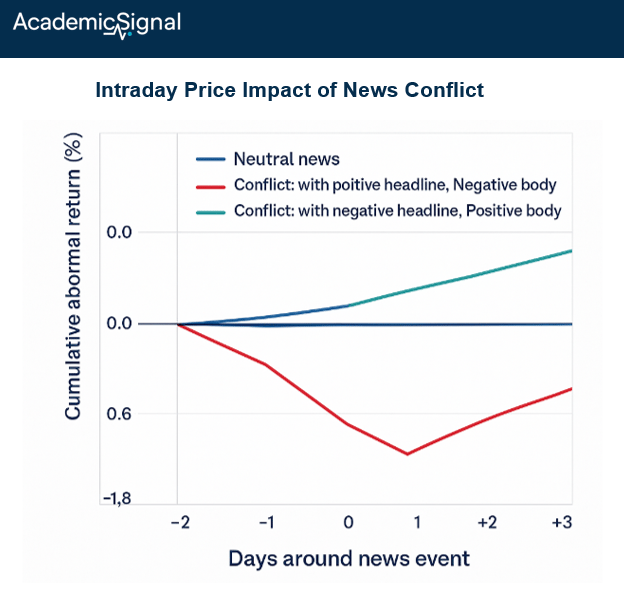

Conflict days are bad for the stock. On average the stock falls on the day the mixed message appears and the weakness often continues for a few days.

If the headline is the negative part, the drop is larger. Headlines are what most people notice first.

Market structure matters. The effect is much bigger in stocks with low institutional ownership and thinner coverage.

You can build a simple trading rule. Go short on conflict days and stay long in names with neutral news. In their tests this produced strong risk-adjusted returns.

An equal-weighted portfolio of long neutral news / short conflict generated daily alpha ≈12bps, which annualized to ~30% after factor controls.

Why this happens

People pay more attention to headlines than to full articles, and negative information gets extra weight. A mixed message raises uncertainty. In uncertainty, investors lean toward the negative. That pushes prices down, especially when the headline carries the bad news.

A simple example

At 10:00 am a tech company gets an article with this headline: “Strong user growth points to bright outlook.” But the body mentions that churn spiked and customer support costs jumped. That is conflict: positive headline, negative body. In the data, those days tend to see the stock drop.

Bottom line

Mixed messages in news are a tradable tell. When headline and body disagree, prices usually lean toward the negative, especially if the headline is the negative piece.

Disclaimer

This publication is for informational and educational purposes only. It is not investment, legal, tax, or accounting advice, and it is not an offer to buy or sell any security. Investing involves risk, including loss of principal. Past performance does not guarantee future results. Data and opinions are based on sources believed to be reliable, but accuracy and completeness are not guaranteed. You are responsible for your own investment decisions. If you need advice for your situation, consult a qualified professional.